Table of Content

Upsides are shorter terms and less expensive closing costs. It’s much easier to convince a lender to give you a loan if it is guaranteed by the VA. In this instance, you take out a larger loan than what is left to settle on your old loan. This extra amount is paid out to you in cash and can also be used however you see fit. Or refinancing another mortgage or lien if it is your primary residence.

This would drastically impact their profitability, as the VA is only responsible for paying off the outstanding loan balance after an account goes into default. Every time a VA loan – or any mortgage – goes into default, the lender loses tens of thousands of dollars in interest-related revenue. Both active service members and veterans are eligible for VA m home loans.

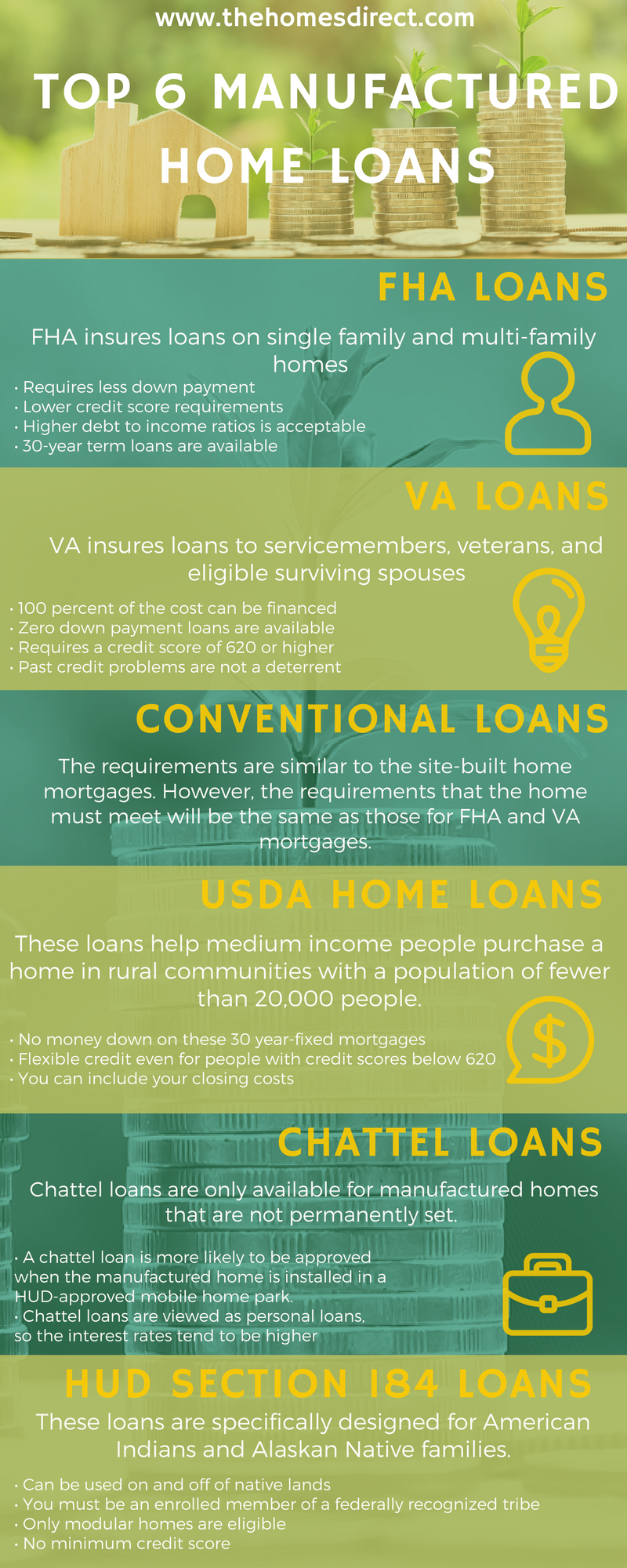

Equivalents of VA loans

These loan programs can be used to purchase a manufactured home, which is a type of prefabricated housing that is built off-site and then transported to its final location. A mobile home can be a smart option to consider if you're struggling to afford a traditional property. However, you'll need to understand the financing options that work with the type of property you want to buy. You'll also need to make sure the mobile home isn't too old to qualify for financing, since some loans only apply to manufactured homes built after 1976. According to HUD guidelines, to qualify for purchase using a VA loan, a mobile home must be properly attached to a permanent foundation and classified and taxed as real property.

The home must meet HUD Manufactured Home Construction and Safety Standards, and should have HUD tags.

Fair Housing Act

Individuals that have already separated from the U.S. military must meet certain minimum service requirements. These requirements have been adjusted periodically over the years, which is why you should check the Veterans Affairs for specific service thresholds. Yes, there are certain requirements that must be met for a manufactured home to be eligible for a VA loan. For example, the home must be built after June 15, 1976 and must be at least 400 square feet in size. If you own the land, for example, you'll be responsible for property taxes in addition to housing costs. Conversely, renting the land your mobile property sits on typically means paying ongoing rental fees.

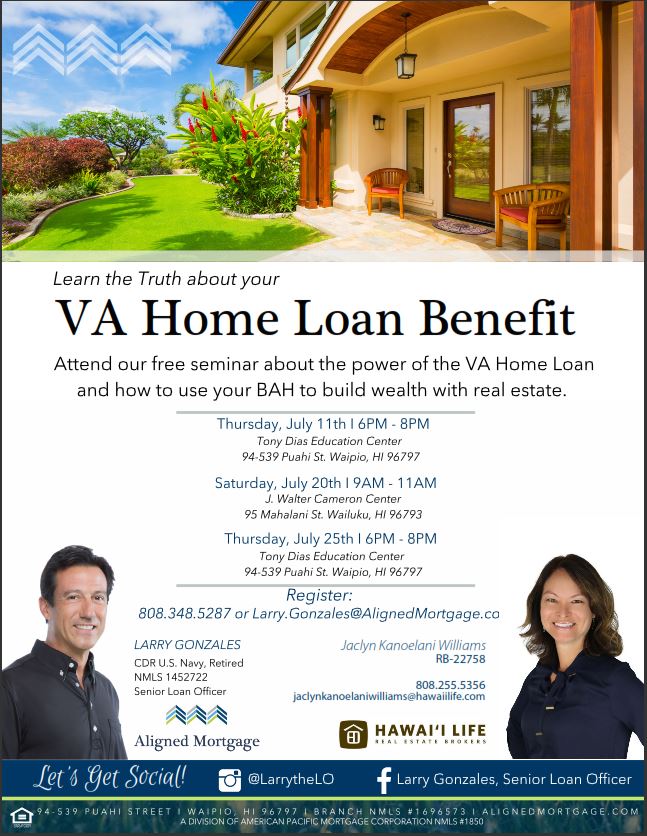

The VA loan guarantee program was especially important to veterans. Under the law, as amended, the VA is authorized to guarantee or insure home, farm, and business loans made to veterans by lending institutions. As of 2020, over 25 million VA home loans have been insured by the government. The VA can make direct loans in certain areas for the purpose of purchasing or constructing a home or farm residence, or for repair, alteration, or improvement of the dwelling. The terms and requirements of VA farm and business loans have not induced private lenders to make such loans in volume during recent years. CMG Financial – CMG Financial is licensed in most states and is a retail and wholesale lender.

VA Loan Articles

The company name, Guaranteed Rate, should not suggest to a consumer that Guaranteed Rate provides an interest rate guaranteed prior to an interest lock. Please note that applications, legal disclosures, documents or other material related to Guaranteed Rate products or services promoted on this page are offered in English only. The Spanish translation of this page is for convenience of our clients; however, not all pages are translated.

When compared to their conventional counterparts, site-built homes, mobile and manufactured homes are certainly more cost-effective. As a result, buying a trailer home rather than a regular home can save you up to 30% on your housing costs. Our goal is for Active Duty Passive Income members to own as much of America as possible.

Unacceptable Va Loan Uses

The VA loan allows veterans 103.6 percent financing without private mortgage insurance or a 20 percent second mortgage and up to $6,000 for energy efficient improvements. A VA funding fee of 0 to 3.6% of the loan amount is paid to the VA; this fee may also be financed and some may qualify for an exemption. In a purchase, veterans may borrow up to 103.6% of the sales price or reasonable value of the home, whichever is less.

It’s not as simple as just having served at some point in time. There are many different criteria depending on the period during which you served. We will highlight the most important ones that will cover the vast majority of readers. There are also provisions under which spouses and other beneficiaries can apply. Therefore, we will pull an IBTS report to obtain the necessary information.

Mobile homes received a bad reputation thanks to early models, which often werent built with quality in mind and depreciated in value quickly. Permanent foundations must also be “site-built,” which means that the structure was constructed on the property where the manufactured home is being installed. Without said foundation, it will be difficult, if not impossible to get approved for a VA loan.

This is definitely important if you don’t know how VA lending works. Many different factors will affect the maximum term of your home loan. This is why you need to talk with your loan officer/home loan specialist to find out all the details about the VA program.

We discuss these in detail further along in the article. VALoans.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC (NMLS #1907), that provides mortgage information and connects homebuyers with lenders.

This loan program is a private sector equivalent to the Federal Housing Administration and VA loan programs. Some lenders will allow you to use a VA streamline loan on mobile home financing, which can help to lower interest rates with few to no out-of-pocket expenses on your end. The home would need to have a VA loan on it currently, the specifics of which your preferred lender must find acceptable. Check with your lender whether they allow this type of loan, and see our VA streamline refinance page to learn about general qualifications. Since mobile homes can be moved from location to location, purchasing one doesn’t necessarily entail purchasing the land on which it’s currently placed.

Other Mobile home financing options

Ideally yes, but it’s going to be challenging to find a VA lender offering zero down payment on construction loans. It can also be used to refinance loans as long as your credit score is good enough. Find out more about what credit score is needed to buy a mobile home here. It has requirements that the borrower must meet and the VA approved lenders need to verify those requirements before providing a loan. The phrases “mobile homes” and “manufactured homes” are commonly used interchangeably when it comes to prefabricated homes. With that said, per the Department of Housing and Urban Development , mobile homes are those built prior to 1976, while manufactured homes are those developed after 1976.

No comments:

Post a Comment